Key Takeaways

- Beware of little expenses. A small leak will sink a great ship.

- A budget tells us what we can’t afford, but it doesn’t keep us from buying it.

- Tough times never last, but tough people do.

- Personal finance is only 20% head knowledge. It’s 80% behavior!

- Money, like emotions, is something you must control to keep your life on the right track.

Introduction

In school, we learn lots of important stuff, but they usually forget to teach us about handling money. “Money Matters” is all about the important things you need to know to get rich, which school doesn’t teach. It talks about simple money stuff like making budgets and smart ways to invest.

This book helps you understand how to save money, deal with debt, and be free from money worries. Let’s dive in together and learn what schools missed about money so we can be in control of our financial future!

The more interesting facts about financial literacy, in fact your school or colleges never teach you

- You can save money without needing a special reason.

- Remember, you’re really important and valuable.

- Some debts are okay, but some are not good.

- Saving is different from investing.

- It’s better to start saving early than to wait until later.

- Having cash isn’t always the best thing.

- Investing is like a smart game if you do it right.

- Don’t forget to take care of important things in life.

- People usually don’t understand risk very well.

- Money can’t make you happy, but it can give you more options.

These all things schools don’t teach you about money, reference by principles personal finance

Financial Literacy 2.0: Essential Money Lessons for True Financial Freedom

These principles cover a range of topics essential for mastering personal finance and achieving long-term financial freedom:

1. Budgeting Basics

Budgeting is like making a plan for your money. First, figure out how much money you have coming in (like your paycheck) and how much you need to spend on important things like rent, food, and bills.

Then, decide how much you want to save or spend on fun stuff. Write it all down and try to stick to your plan each month. That way, you can make sure you don’t spend more money than you have.

2. Saving Strategies

Saving money is important for your future. One simple way to save is to set aside a little bit of money from each paycheck. You can also try to cut back on small things like eating out or buying snacks.

Another good idea is to have a goal in mind, like saving up for a new bike or a special trip. By saving a little bit at a time and being patient, you can watch your savings grow over time.

3. Debt Management

Debt means you owe money to someone else. It’s important to manage your debt wisely so it doesn’t become a big problem. First, try to avoid getting into too much debt by only borrowing money for things you really need. If you already have debt, like a credit card balance, try to pay it off as soon as you can.

“To build wealth time works for you and to destroy wealth time works against you.”

Make a plan to pay a little bit extra each month, and try not to borrow more money until you’ve paid off what you owe. That way, you can avoid paying extra money in interest fees and get rid of your debt faster.

Also Read: Accelerate Your Wealth: The 6 Golden Rules of Money Management

4. Investment Insights

Investing is like planting seeds that grow into money trees over time. Start by learning about different types of investments, like stocks, bonds, or real estate. Then, decide how much money you want to invest and choose investments that match your goals and risk tolerance.

It’s important to diversify your investments, which means spreading your money across different types of investments to reduce risk. Remember to be patient and think long-term because investments usually take time to grow.

5. Financial Goal Setting

Setting financial goals is like making a map for your money journey. Start by thinking about what you want to achieve, like buying a house or going to college. Then, break your big goals into smaller, more manageable steps.

Write down your goals and make a plan for how you’ll reach them, including how much money you’ll need and how long it will take. Keep track of your progress along the way and adjust your plan as needed. Setting clear goals can help you stay focused and motivated to reach your dreams.

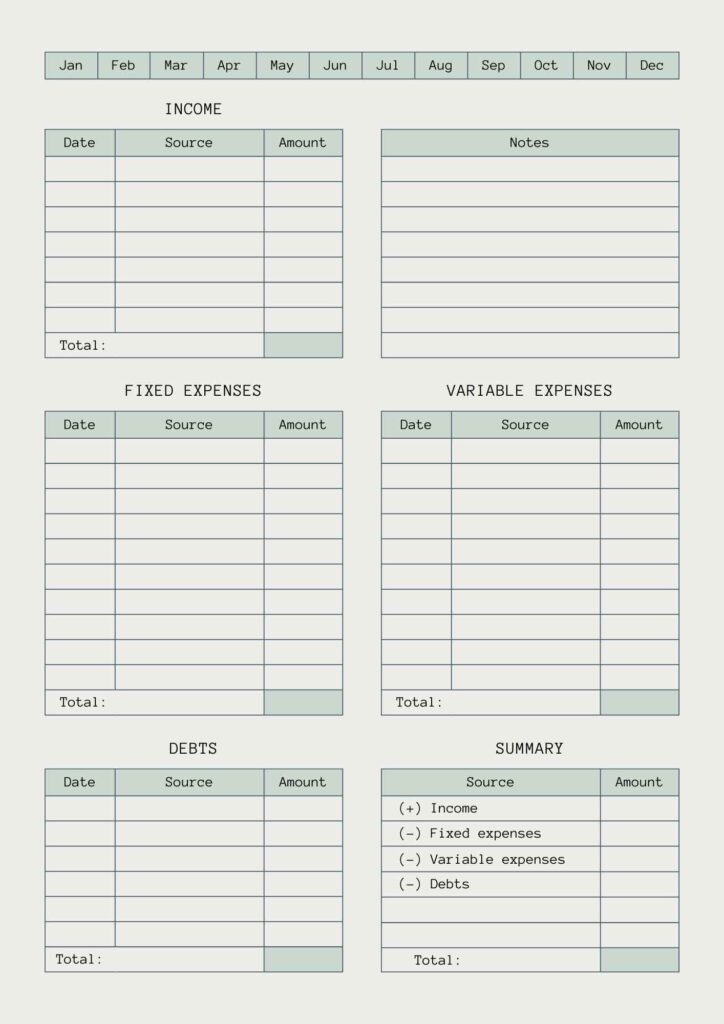

Use this PDF template to manage your personal monthly finances, Download Now

6. Emergency Fund

An emergency fund is like a safety net for your finances. Start by saving a small amount of money each month until you have enough to cover your expenses for a few months, like rent, food, and bills. Keep your emergency fund in a separate savings account so you’re not tempted to spend it on non-urgent things.

Having an emergency fund can give you peace of mind knowing that you’re prepared for unexpected expenses, like car repairs or medical bills, without having to borrow money or use credit cards.

7. Insurance Essentials

Insurance is like a safety blanket for your finances. Start by understanding the different types of insurance, like health, car, or home insurance, and decide which ones you need based on your situation. Shop around to find the best coverage at the most affordable price.

Remember to review your insurance policies regularly to make sure you’re still getting the best deal and that your coverage meets your needs. Having the right insurance can protect you from financial disasters like accidents or unexpected medical bills.

Also Read: Building Wealth for the Future: A Step-by-Step Guide to Financial Independence

8. Retirement Planning

Retirement planning is like preparing for a long vacation without work. Start by thinking about how much money you’ll need to live comfortably in retirement. Consider factors like your living expenses, healthcare costs, and any other expenses you’ll have. Then, start saving as much as you can for retirement, whether it’s through a 401(k), IRA, or other retirement accounts.

Take advantage of any employer-sponsored retirement plans and contribute enough to get any matching contributions. The earlier you start saving for retirement, the more time your money will have to grow.

9. Estate Planning

Estate planning is like writing a letter to your future self and loved ones. Start by making a list of all your assets, like your home, car, savings, and investments. Then, think about who you want to inherit your assets and who you want to make decisions for you if you become unable to do so yourself.

Consider working with a lawyer to create important legal documents like a will, power of attorney, and healthcare directive. Review your estate plan regularly and update it as needed, especially after major life events like getting married, having children, or buying property.

10. Continuous Learning

Continuous learning is like adding new tools to your financial toolbox. Start by staying curious and open-minded about new ideas and opportunities to learn. You can read books, listen to podcasts, or attend workshops and seminars about personal finance. Take advantage of online resources and educational websites to expand your knowledge.

“It is a good thing to try and be financially secure and I think is something we all can try to achieve.”

Surround yourself with people who are also interested in learning about money and share your experiences and insights with each other. Remember that learning is a lifelong journey, and the more you know, the better equipped you’ll be to make smart financial decisions.

About the Author

Cary used to work in big companies, leading teams in marketing and sales. He’s given talks at lots of meetings and seminars. By following the ideas from his book, along with working really hard, he was able to stop working and retire when he was only forty-five.

You can find out more about his book on his website, carysiegel.com, or whydidnttheyteachmethisinschool.com.

Why Didn’t They Teach Me This in School?: 99 Personal Money Management Principles to Live By Cary Siegel

This is a book that helps people learn important things about managing money that they didn’t learn in school. It talks about simple but helpful ideas to help you handle your money better.

From saving money to avoiding debt and making smart decisions about spending and investing, this book covers many useful tips and tricks. It’s like having a friend who knows a lot about money and wants to share their knowledge to help you live a better financial life.

Amazon ratings: 4.4 out of 5 stars 2,286 ratings, 3.8 on Goodreads and 2,110 ratings.

Conclusion

“Financial Literacy 2.0” is like a guide to being free with money. If you learn and use the important lessons from this book, you can manage your money better and make a safe future for yourself. It teaches you about making budgets, saving money, and investing smartly.

These skills help you make good decisions about money. Anyone who wants to learn and do something about it can reach financial freedom. So, start your journey to a better financial future now!

FAQs:

Q:1 Why doesn’t school teach about making money?

Schools focus on other subjects.

Q:2 Why doesn’t school teach about investing?

It’s not part of the curriculum.

Q:3 What are the disadvantages of financial literacy in schools?

Lack of resources and time.

Q:4 Why don’t high schools teach financial literacy?

It’s not seen as a priority.

Q:5 Is financial literacy good or bad?

Financial literacy is good for making smart money choices.